SAVE TIME AND GET THE BEST FINAL EXPENSE INSURANCE QUOTES BASED ON YOUR NEEDS AND BUDGET

Get the Best Quotes for Final Expense Insurance

"*" indicates required fields

Life Insurance Vs. Final Expense Insurance

What is the difference between life insurance and final expense insurance? Which one should you buy to plan for the future?

These are very good questions to ask if you want to secure the future of your loved ones financially or when you want to ensure funds for your end-of-life arrangements.

While final expense insurance is a form of life insurance, these 2 insurance products work differently and cost differently.

Life insurance is designed to replace lost income at death while final expense insurance is meant to pay for funeral or burial costs.

Find out which one you should get to suit your needs by reading on and compare multiple offers to find the right price!

Just fill out the form on this page to get FREE and NO COMMITMENT quotes. But do take your time to learn more to get the insurance protection you need.

Do you need life insurance or final expense insurance?

We all need some form of life insurance to plan for the future. Even if you have no dependents, you will still need money to pay for final expenses such as remaining credit card bills, taxes, medical bills, and funeral and burial costs. Without insurance, a relative would have to pay for end-of-life expenses.

Unless you have a lot of cash in the bank, it is advisable to put in place a life insurance policy to take care of these expenses.

Determining whether you should buy a life insurance policy or a final expense insurance policy depends on the following:

- The purpose of the insurance benefits

- Your age and health status

- Your finances

- Existing insurance coverage

We will explain in detail so you can assess your current situation, future plans, your needs, and your budget.

Life insurance benefits and how it works

Many people don’t like to talk about life insurance. We tend to postpone buying life insurance using different excuses like- I can’t afford it, I will buy it later when I have a family, I don’t have any dependents, I have enough savings.

The truth is, we like to think we don’t need life insurance and avoid thinking of the big “what if” question.

So, before you can start planning for your future, you need to ask yourself:

- Who will be impacted financially if I should die suddenly die?

- How much is needed to keep my dependents financially secure if I should suddenly die?

- What debts are outstanding if I should suddenly die?

- How much savings will I be leaving behind if I should suddenly die?

- How much is my existing life insurance protection and is it sufficient?

- How much can I afford to pay for life insurance coverage now?

- How long do I need life insurance coverage for?

When you have answered these hard questions, you will fully understand how much you need for life insurance and make a smart choice.

Types of life insurance to choose from

Life insurance comes in different forms, with each one offering unique advantages and benefits.

In order for you to buy the right life insurance coverage, it is important to understand your choices and how they can benefit you in the long run.

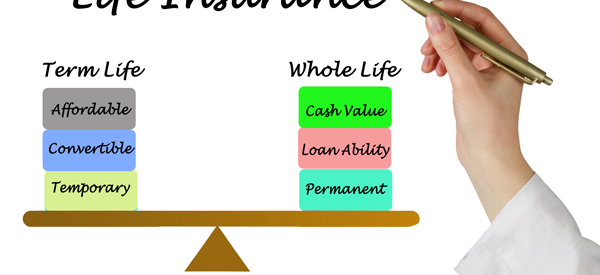

Life insurance generally falls under two categories – term life insurance and permanent life insurance.

What is term life insurance?

Term life insurance provides you with coverage for a specified time called term. If an insured person dies within the insurance term with premiums paid to date, the insured amount is paid to designated beneficiaries.

It is the most affordable type of life insurance in the market but it does not accumulate cash value. The only benefit would be the death benefits. If a policyholder cancels the policy, paid premiums are not refunded. If the insured person outlives the term of the policy, no benefits are paid but the policy could be renewed for another term.

What is permanent life insurance?

Permanent life insurance is coverage for a lifetime. It is designed to replace the insured’s income at death to make sure his loved ones can continue their lifestyle.

With this type of policy, death benefits are paid regardless of when the insured dies. It never expires and the premiums stay level for life.

This type of insurance is more expensive than term life insurance but over time, they accrue cash value that the policy owner can borrow against. Further, because it is good for a lifetime, it guarantees your insurability. Compared to term life insurance which expires and gets more expensive with every renewal, permanent life insurance makes more sense when you need insurance protection for life.

Not everyone qualifies for permanent life insurance. Some medical conditions or factors like age or financial capacity can prevent some people from getting permanent life insurance coverage.

The best thing to do is to get life insurance protection that you qualify for. Whether it is permanent life or term life insurance, doing it now than postponing it until it is too late is never a good idea.

If you can’t afford permanent life insurance now, you can get term life insurance and upgrade to permanent coverage later on.

If you can’t qualify for permanent life insurance due to health conditions or age, get term life insurance protection.

If you qualify and can afford permanent life insurance, it is worth the investment.

Who needs life insurance?

An individual who has accumulated sufficient wealth to leave to his dependents or loved ones when they pass may no longer need life insurance. The money should also be sufficient to pay for taxes, debts, final bills, and burial costs.

If you don’t fall in this privileged category, you will most likely need some form of life insurance, no matter how small.

Below are a few key takeaways in determining the need for life insurance.

· Not everyone needs life insurance but certain circumstances can make buying life insurance a good idea.

· If you don’t think you have enough money in savings to pay for retirement, a whole life insurance policy can help.

· If you are a homeowner, it is also a good idea to have a life insurance policy that can help to pay the mortgage if you should suddenly pass.

· If you are a business owner and want to leave a legacy, it is also a good idea to buy life insurance to take care of the business.

· If you have children and dependents or want to bequeath a legacy to a spouse, it is also strongly recommended to buy life insurance.

· If you and a partner are building a life together, a life insurance policy for couples is also a good idea.

· If you are retired and your savings don’t seem sufficient to leave funds for final expenses, it may also be a good idea to look for additional life insurance.

Term life & Permanent Life Insurance Benefits

These are the 2 basic types of life insurance that you can buy to protect your family’s financial security. Term can be set for a specified period of time. Permanent is for lifetime coverage.

The main objective for life insurance is protection of your finances in the event of your demise. You may have someone or something valuable such as your family, your home, or your business.

Term life insurance is cheaper than permanent life insurance. However, it does not have cash value and no surrender value. If you outlive a term life insurance policy, you won’t receive any benefits.

Term life insurance can also be converted to permanent life insurance.

Permanent life insurance – universal and whole life insurance- protects you throughout your life. It does not expire and cannot be canceled as long as premiums are paid even if your health deteriorates.

Understanding these two types of life insurance will help you to choose the right coverage for your needs. Look further down the road, and not just the present. Thinking long-term is important to get adequate coverage.

Life insurance has become more flexible and innovative, allowing you to combine term life and permanent life insurance solutions to suit your lifestyle and budget.

Compare term life and permanent life insurance costs

There is no denying that permanent life insurance is more expensive than term life insurance in terms of premiums.

When it comes to overall value, however, permanent life insurance guarantees lifetime insurability, does not increase in price throughout your life, and accrues cash value which you can borrow against.

Term life insurance can be renewed when it expires but every renewal will come with an increase in premiums. If your health deteriorates, you can also get denied.

Below you will find a comparison of prices for term life and permanent life insurance to be your guide.

Cost of term life insurance for $250,0000

| Female, non-smoker 50 years old | 20-year term life policy | $53 monthly |

| Male, non-smoker 50 years old | 20-year term life policy | $74 monthly |

| Female, non-smoker 45 years old | 20-year term life policy | $35 monthly |

| Male, non-smoker 45 years old | 20-year term life policy | $48 monthly |

| Female, non-smoker 40 years old | 20-year term life policy | $24 monthly |

| Male, non-smoker 40 years old | 20-year term life policy | $29 monthly |

** These rates are for illustration only and are not actual quotes.

The average insured amount purchased by Canadians aged 50 and younger is $500,000.

As you can see, monthly premiums for term life insurance can cost as much as a cup of coffee per day. The price is lower when you buy life insurance at a younger age.

Buy term life insurance before your next birthday to take advantage of lower premiums for the next 20 years for a 20-year term life insurance policy.

The cost of permanent life insurance policies can be three times the cost of a term life insurance policy. It is best to get lifetime protection as young as possible to get lower rates. You can also get a lower insured amount to get lower premiums and combine it with term life insurance protection.

These are the 2 basic types of life insurance that you can buy to protect your family’s financial security. Term can be set for a specified period of time. Permanent is for lifetime coverage.

The main objective for life insurance is protection of your finances in the event of your demise. You may have someone or something valuable such as your family, your home, or your business.

Term life insurance is cheaper than permanent life insurance. However, it does not have cash value and no surrender value. If you outlive a term life insurance policy, you won’t receive any benefits.

Term life insurance can also be converted to permanent life insurance.

Permanent life insurance – universal and whole life insurance- protects you throughout your life. It does not expire and cannot be canceled as long as premiums are paid even if your health deteriorates.

Understanding these two types of life insurance will help you to choose the right coverage for your needs. Look further down the road, and not just the present. Thinking long-term is important to get adequate coverage.

Life insurance has become more flexible and innovative, allowing you to combine term life and permanent life insurance solutions to suit your lifestyle and budget.

What is final expense insurance and who needs it?

Final expense insurance is a type of life insurance to cover funeral expenses. It can also be used to pay for medical bills, credit card bills, or loans, as deemed appropriate by the beneficiary. This is because unlike prepaid funeral plans, the death benefit is paid to the beneficiary, tax-free.

This type of policy is quite popular among seniors who want life insurance benefits specifically to pay for funeral expenses. Premiums are fixed and the application process is easier. Even individuals who have been previously denied traditional life insurance due to health conditions can be approved for coverage without a medical exam!

How to apply for final expense insurance

You can buy life insurance from insurance companies through their brokers or agents. You will need to fill out an application form. Some companies offer final expense insurance without a medical exam or with just a short health questionnaire.

There are 2 types of final expense insurance – guaranteed and simplified issue.

Guaranteed issue final expense insurance requires no medical exam and can be approved quickly. However, the insured amount is lower than traditional life insurance (between $5,000 to $20,000) and the premiums are more expensive.

Simplified issue final expense insurance requires filling out a health questionnaire and can also be approved within days. The premiums are lower than guaranteed issue final expense insurance but the insured amount is also typically from $5,000 to $20,000.

Are you interested to see how much final expense insurance will cost you? Check out the 2023 cost of final expense insurance in Canada for more information.

To apply for final expense insurance, you can fill out our short online form and our insurance partners will be happy to assist you!

Pre-qualifying questions for simplified issue final expense insurance

If you choose to apply for simplified issue final expense insurance, you may need to answer some qualifying questions such as:

- Are you presently bedridden, in a hospital, care facility, or receiving hospice care?

- Do you have heart disease or have had a heart attack or surgery?

- Have you experienced a stroke or have a disease of the circulatory system?

- Have you been diagnosed with cancer?

- Do you have HIV or AIDS?

- Do you have a history of drugs or substance abuse?

- Do you have

- dementia or Alzheimer’s?

- Are you taking medications or receiving medical treatment for any of these conditions in the last 2 or 3 years?

If you don’t want to answer health questions, the final solution to getting life insurance for funeral expenses is a guaranteed issue policy. While the premiums are higher, there is no medical exam and no health questionnaire.

With final expense insurance, most people can still qualify to get coverage even with existing health conditions.

Levels of Benefits for Final Expense Insurance

Since final expense insurance policies aim to pay for burial or funeral costs, the insured benefits are generally below $50,000, with most policy owners choosing from $10,000 to $20,000. Lower insured amounts also keep the premiums reasonable.

The benefit amounts approved by insurers also depend on the state of your health and your goals. For no medical exam policies, the coverage is usually from $5,000 to $10,000.

Beneficiaries of final expense insurance

A policy owner can choose his beneficiary and they are classified as primary, secondary, and tertiary.

A primary beneficiary gets 100% of the death benefits when the insured individual passes. In case the beneficiary dies before the insured, the secondary beneficiary receives the death benefits. A tertiary beneficiary is usually the last choice and only receives the death benefits if the first and second beneficiary dies before the payout.

It is also possible to divide the insurance proceeds among multiple beneficiaries.

It is important to designate an adult as a beneficiary to ensure the proper disbursement or distribution of the death benefits.

It is also important to review your coverage from time to time to make sure it is adequate and up to date.

If you want to know how much life insurance will cost and what your options are, fill out the form below and get FREE quotes from our reliable insurance partners!

FAQs about life insurance and final expense insurance

We have provided a lot of relevant information regarding life insurance and final expense insurance in this article.

However, we know that choosing the right policy and insurer can be overwhelming. You may still have questions so we have compiled a few relevant FAQs that can guide you in your choice.

Can smokers qualify for life insurance?

Yes, smokers can get life insurance but they usually pay as much as 30% more in premiums. Insurers usually set 2 tiers for premiums – smoker’s rate and non-smoker’s rate for both men and women.

Why are final expense insurance policies more expensive than traditional life insurance?

Final expense insurance is more expensive than traditional life insurance because it is designed for hard-to-insure individuals who won’t normally qualify for regular life insurance. The risks for insurers are higher, and some policies (the most expensive ones) don’t require a medical exam.

Most people who apply for final expense insurance are seniors with medical conditions.

Should I get term life insurance or final expense insurance?

If you can still qualify for standard term life insurance, it is the cheaper alternative. You may also qualify for a higher insured amount.

For individuals 60 years or older and don’t get approved for standard life insurance policies, the next best option is final expense insurance. Speak to a broker and get your best options before making your decision. You can get in touch with reliable brokers using our short online form.

What is the maximum age to get final expense insurance?

Different insurers have their own age requirements, with some capping the age at 75 while others accept up to 80. Keep in mind that the older the insured, the more expensive the premiums are.

How does final expense insurance work?

Final expense insurance pays out death benefits to the beneficiary, tax-free. The benefits are not paid immediately after death so in most cases, family members may have to advance the payment for funeral costs and get reimbursed.

Can I buy final expense insurance for my parents?

Yes, it is always possible to buy final expense insurance for a relative like a parent or a grandparent.

How much is the recommended insurance amount for life insurance?

There is no one-size-fits-all answer for life insurance because each individual has a different set of circumstances in life. You will need to determine the right level of coverage for yourself by assessing the purpose of your insurance, your financial status, and future goals. An easy way to do this is to ask yourself how much money you need to leave to your dependents, pay off your debts, and cover your funeral costs in case you die.

Can I still get denied final expense insurance?

Most individuals can still get final expense insurance despite existing health conditions. However, you can still get denied coverage if you are over the age requirements of the insurance company or don’t meet some requirements. For instance, seniors in hospice care or in long-term care cannot get coverage.

Is it advisable to get guaranteed final expense insurance?

Guaranteed final expense insurance is the most expensive type of insurance available for seniors. It is available for those who don’t have any other option to get coverage. Some seniors get this type of policy when they want to leave a small legacy to a beneficiary or want funds set aside for funeral expenses. It is advisable if the applicant does not qualify for standard life insurance but want a lower amount of insurance ($25,000 or less).

Do I still need life insurance if I am single?

It may seem like you don’t need life insurance if you are single. This can be true if you have no debts to leave behind and no dependents to worry about. There is still that question about paying for your funeral. If you have company insurance and savings that would be sufficient if you were to die suddenly, you probably don’t need additional coverage. Keep in mind, however, that company insurance (group insurance) ends when you leave your employment. You may also decide to get married and have kids in the future by which time your insurance premiums will be higher.

What is the difference between life insurance and final expense insurance?

Standard life insurance policies offer higher insured amounts because they are designed to replace income. They also cost less compared to final expense insurance for the same amount. Final expense insurance policies are designed to pay for funeral and other end-of-life expenses and offer low insured amounts. They are intended for individuals who don’t qualify for standard life insurance.

Is funeral and burial insurance the same as final expense insurance?

Yes, funeral, burial, and final expense insurance policies are the same. They are called different names by the insurance companies who sell them. Depending on the insurer, each policy can have different pricing and features.

How fast do insurance companies pay out claims?

This depends on the insurer as they have their own procedures for claims. It also depends on the circumstances of the claim. For instance, if the insured did not die of natural causes, the payout may be delayed until such time that an investigation is satisfactorily concluded. Most insurers don’t pay death benefits for suicides. If everything is cut and dried, death benefits can be paid within days. For some insurers, it could take weeks or months.

Free Life Insurance & Final Expense Insurance Quotes

Don’t delay buying life insurance to find lower premiums for the right coverage!

No matter what stage in life you are now, life insurance benefits will help your loved ones to cope with your loss, especially when it comes to paying for funeral expenses.

If you buy term life or whole life insurance, the tax-free benefits can help pay for your mortgage, taxes, debts, and ensure a quality lifestyle for your family!

Find the best life insurance to protect you and your family or pay for your final expenses using our short online form!

Our insurance partners will be happy to offer you competitive and no-obligation quotes to compare and choose from.

Get peace of mind and plan your future with the right life insurance or final expense insurance coverage today!

Comments are closed.

SAVE TIME AND GET THE BEST FINAL EXPENSE INSURANCE QUOTES BASED ON YOUR NEEDS AND BUDGET

Get the Best Quotes for Final Expense Insurance

"*" indicates required fields

Copyright© 2025 Compare Home Quotes.

Oolong Media